What we are watching

I’ve been selling real estate here at the beach for almost 18 years. I’ve seen markets drop like a rock and shoot up like a rocket but this market – the one we are currently in – is new to me. Why? Because it’s really not doing anything…” normal”. For the last couple of years, since Covid, we have been on that rocket ship with prices climbing by the day but now it feels like in July everything all of a sudden…stopped. Example, our team had been averaging 21+ transactions a month from January through June and then July hit, and we closed only 8 transactions. In August it was 8 transactions again. What happened? Did we suddenly forget how to sell real estate? Did we all go on vacation at the same time? Did we just say, forget it, I quit? No, no and no. In fact, I can assure you we are working harder than ever.

It isn’t only us. Our entire MLS is down. I also saw a report that the city of San Diego saw its sold transactions dropped 45% in July and another report proclaiming that the across the country real estate is down 30%. August was more the same. September – we will see.

If you are a buyer or seller of real estate here at the beach, what do you do? What is the answer? Here’s what you do, at least here’s what we are doing. We are monitoring what I call “The Confidence Quotient” of our real estate market. In other words, do people believe the market is going: up, down, or sideways? Where is their confidence?

The way I measure The Confidence Quotient in our real estate market is by monitoring five key trends:

1. Number Of Sales

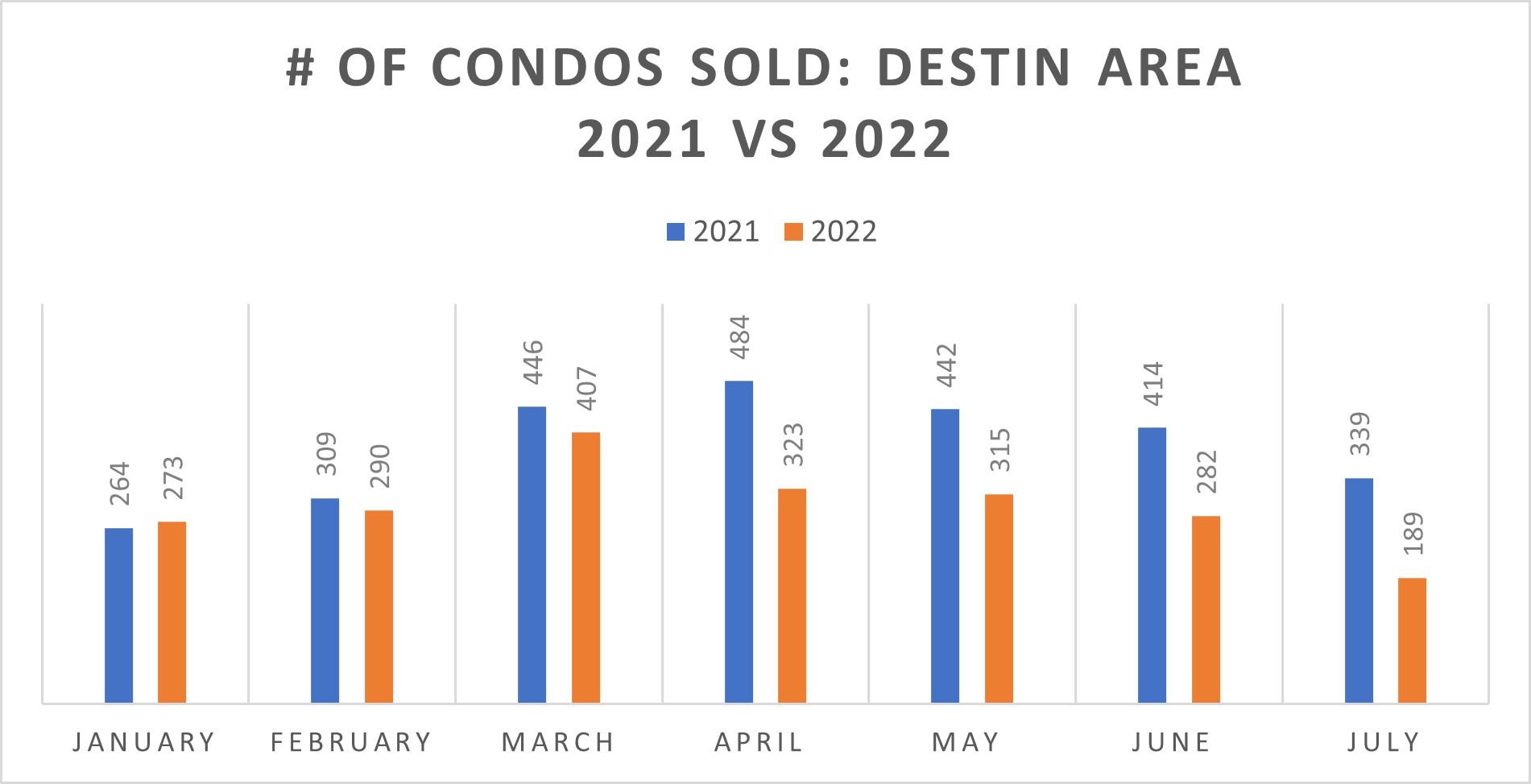

The number of sales will tell us a Buyer’s Confidence in the market. If the number of sales is increasing, it tells us that buyers are confident future prices will be higher, so they are buying now. If the number of sales is going down, we know buyers are confident that future prices will be lower so they are opting out at the current market prices. Additionally, look for prices to erode at least for the near term. Make sense? Okay, let’s look at condo sales in the Greater Destin Area to see if we can determine where the market is going.

Destin Condo Sales: Year over year condo sales in the Greater Destin Area are down and what’s even more interesting is they have been trending down since their peak in March of this year.

Conclusion? It would appear demand for condos at the beach is softening.

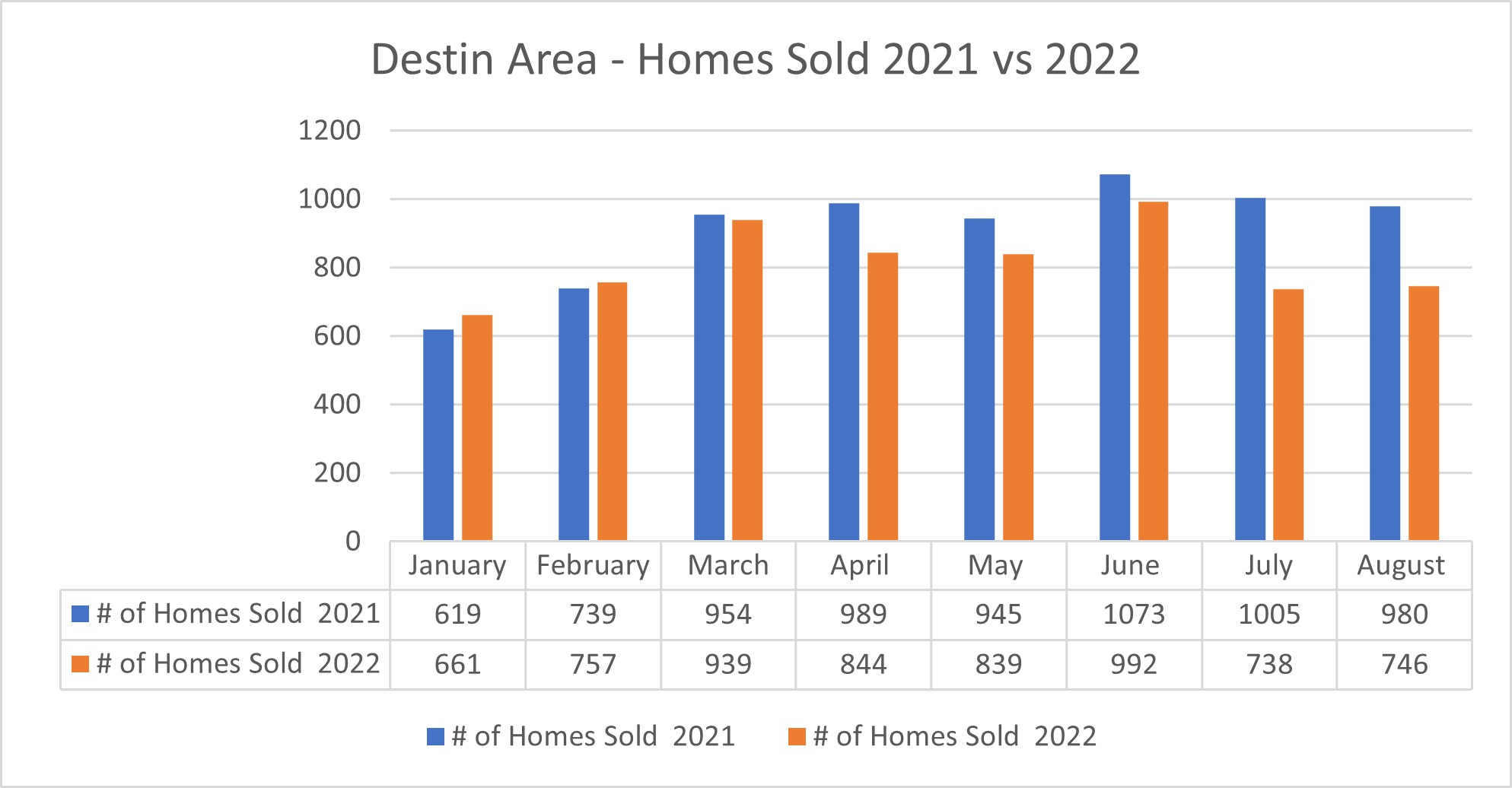

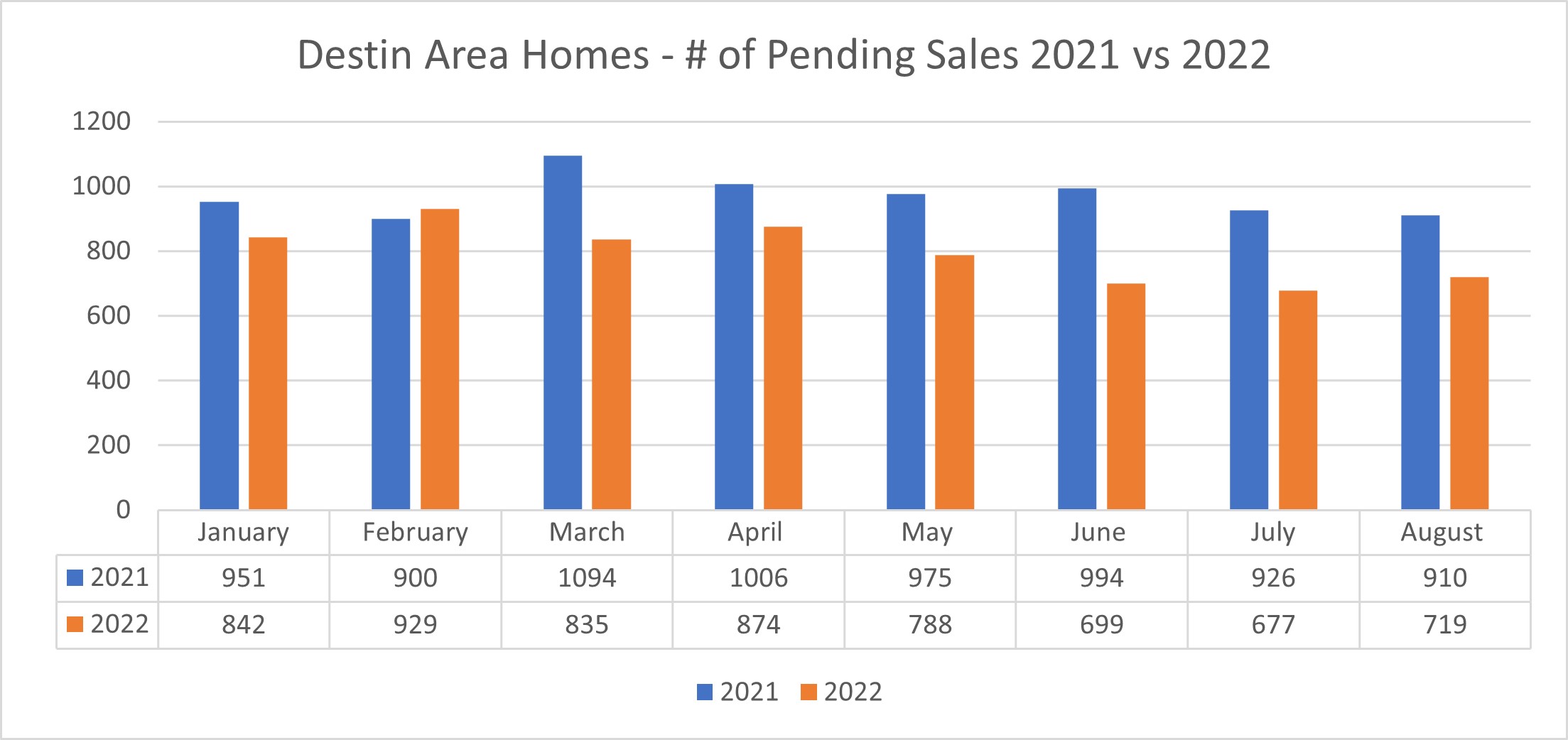

Number of Destin Home Sold: Home sales this year, while lower than last year have followed the similar pattern of climbing in the first quarter, then falling back in April and May, jumping up in June before falling back again in July and August.

Conclusion? There are definitely not as many buyers this year pulling the trigger and buying property however the sales numbers for July and August showing up as flat (not dropping) would suggest that buyer confidence may be coming back somewhat.

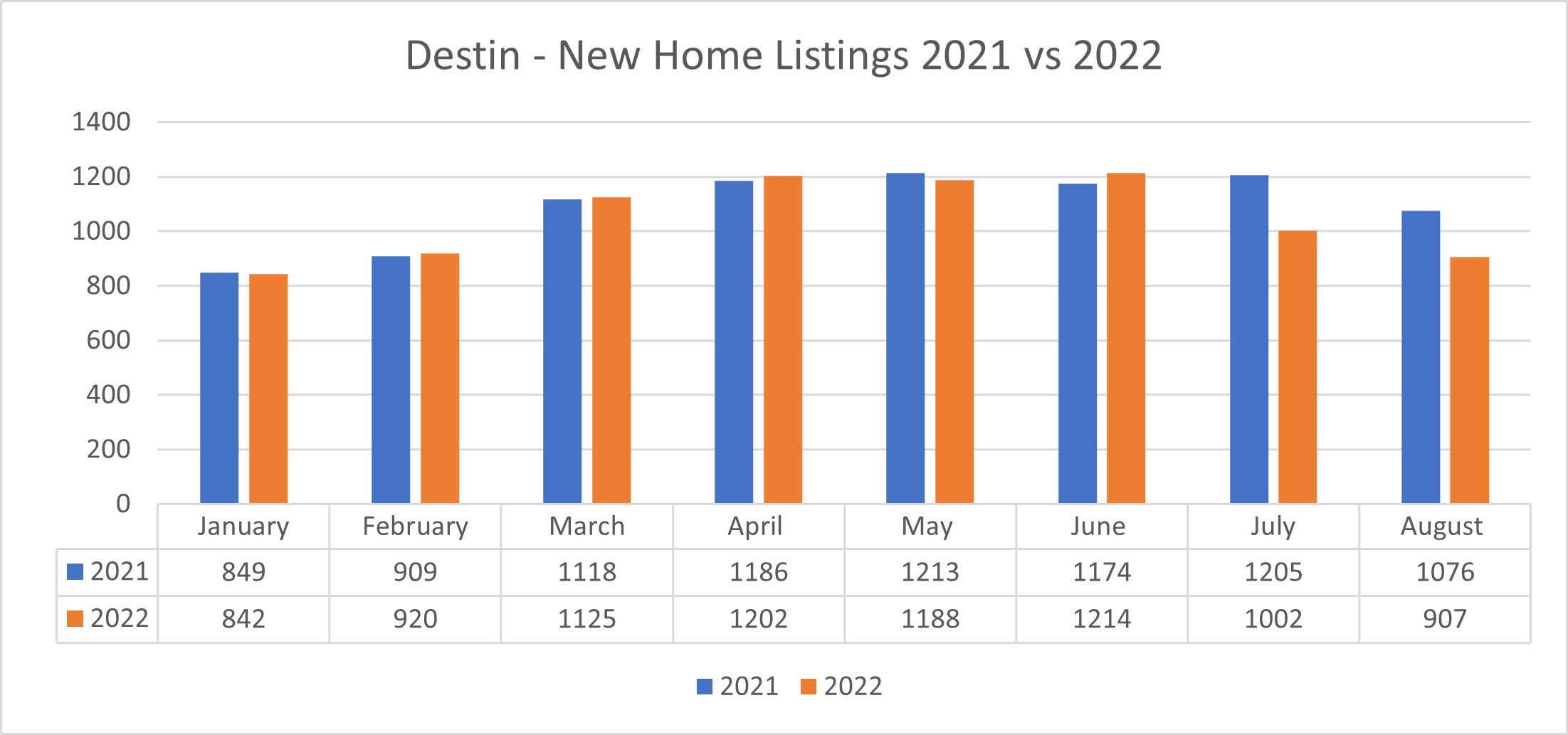

2. How many New Listings are coming on the market for sale?

If inventory (properties listed for sale) is increasing, it indicates that Seller Confidence is high and prices are going to hold up, at lease for the near term. As such sellers are listing now and hoping to sell before prices start dropping.

Destin Condo New Listings: It’s interesting to see how the number of new condo listings dropped off this year compared to last year. Perhaps even more interesting is how they’ve dropped compared to earlier in the year. Especially when July and August are usually very strong listing months.

Another thing we have seen is sellers pulling their listings off market because they don’t have confidence they can capture the price they want in order to sell. Market values have jumped so much over the past few years and rents have been so strong that a lot of sellers are simply deciding to hold on to their properties until they can capture a higher sales price.

Conclusion? It looks like we may have an old fashion stare down between supply (sellers) and demand (buyers) to see who blinks first, which will make any move by the Fed even more impactful. Stay tuned on that.

Destin Homes New Listings: New home listings were running pretty even to last years numbers until July when they dropped off substantially. I think this is the interest rate hikes and inflation coming come to roost. Unless there is a pressing need to sell it looks like homeowners in the Greater Destin Area are choosing to sit tight for a while.

Conclusion? The lack of inventory (supply) and the likely mortgage rate increase will be hard on buyers looking for lower prices.

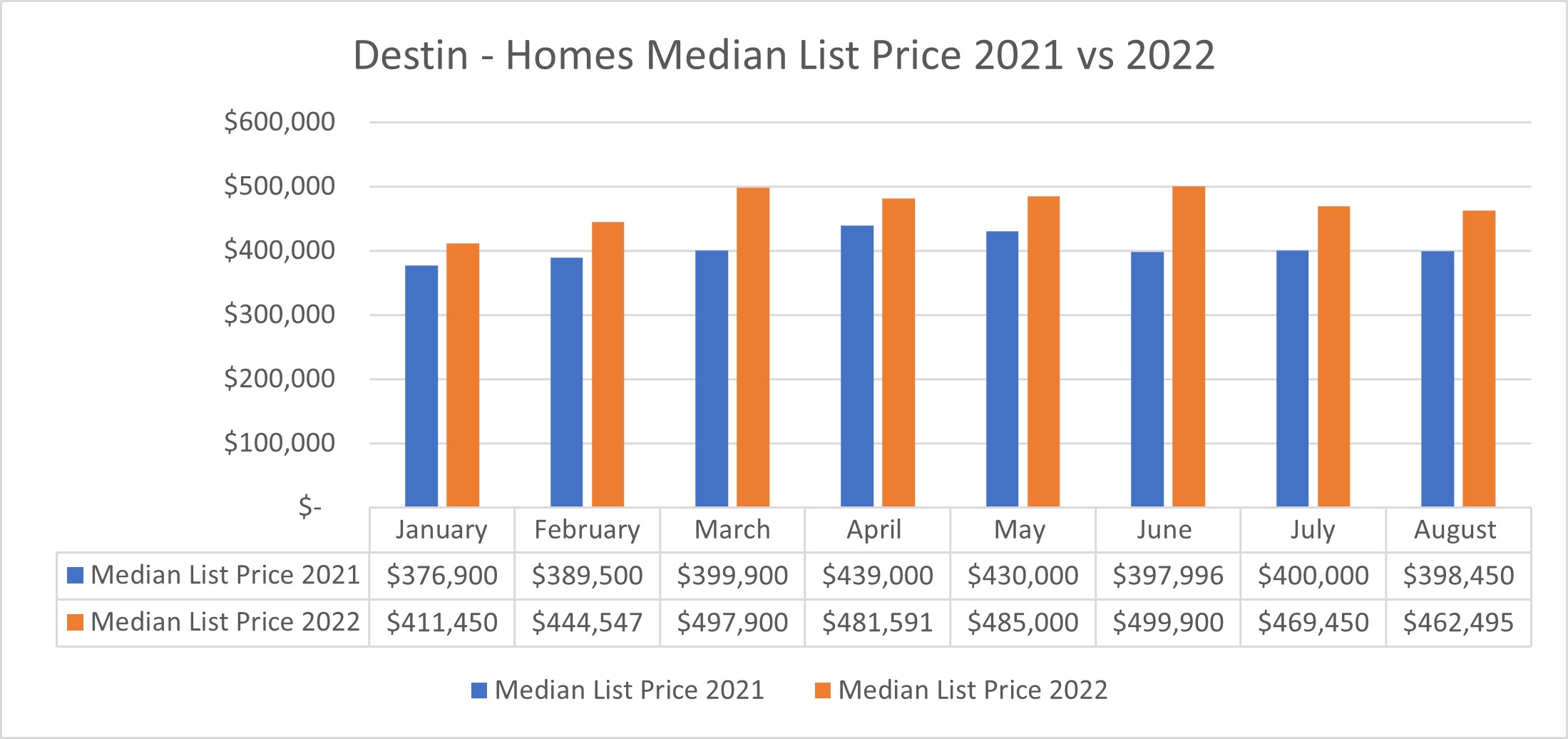

3. Are New List Prices higher, lower, or the same as previous months?

This will tell us which way the ‘value’ winds are blowing. If New List Prices are higher, sellers are confident that market will hold up and they will get their price. If new list prices start dropping, sellers are worried that if they don’t get a high price now, they may have to hold the property or sell in a depreciating market. If new list prices are flat? This simply means sellers are uncertain which way the market will turn.

Destin Condo New List Prices: This year’s new list prices are certainly higher than last years – no surprise there. The thing that surprises me a little is that new list prices are holding up even in the face of significantly few sales (closings). New list prices have come down some over the year but not much which tells me that sellers have confidence in the future and are not fire selling at this time.

Conclusion? It still looks like the sellers hold most of the cards and if buyers are hoping for price relief, I’m not sure they will find it.

Destin Home List Prices: Looking at the New Listing Prices for homes in the Greater Destin Area it looks like prices are up year over year – again no surprise there. And like with the condo market list prices are coming down some – but not much. This is pretty incredible considering the drop in the number of sales, the increase in interest rates and the growing overall inflation all of which typically force prices down. That has not been the case so far in the Destinland area.

Conclusion? It’s gong to be tough on buyers looking to capture lower prices. However, sellers will likely see the time it takes to sell a property jump as the number of buyers able to pay high prices drops.

4. How many properties are Pending Sale (under contract but not yet closed)?

This is about Buyer Confidence. If the number of pending sales is increasing, we know that Buyer Confidence remains high and that they are still willing to write contracts even at the current price points. If the number of pending sales drops, then prices are likely to drop as well. If they are flat (not increasing or decreasing) then it simply means buyers and sellers haven’t decided yet.

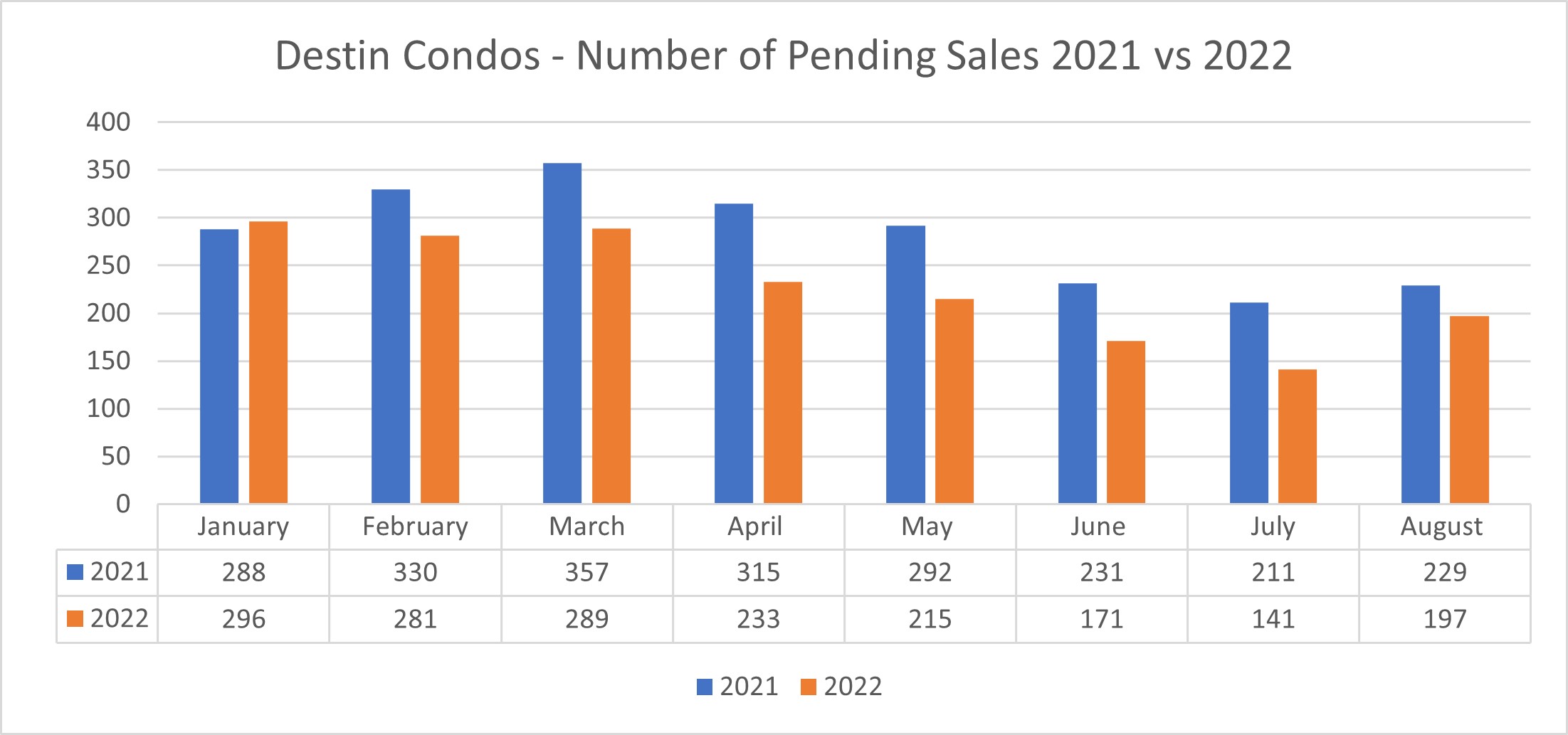

Destin Condos: # Of Pending Sales: The number of condos going under contract this year compared to last year is down substantially. The thing that jumps out at me on this graph is how much the August pending sales jumped up from last month. We have been hearing so much about how the housing market is in trouble and that there is a bubble about to burst but then our pending sales jump. Very interesting. I don’t know if this trend can keep going but right now the pending sales tell us that buyers are confident that if they don’t buy now, they will pay higher prices in the future.

Conclusion? With so much uncertainty, if you are planning on selling in the next few years – sell now while we know you can capture a high price.

Destin Homes: # of Pending Sales: The number of pending sales is down significantly year over year but interestingly they are up from last month. Is this a seasonality thing showing up, is it a blip before prices drop, or is it something else entirely? Hard to say at this point.

Conclusion? There is so much talk and punditry out there right now it hard to get a good indication where this trend is taking us. Honest answer… be careful.

5. Are new pending prices higher or lower than the previous pending sales?

Like with New List Prices, Pending Prices will tell us which way the ‘value’ winds are blowing. If Pending Prices are higher from one month to the next for comparable properties prices are going to remain high or go higher. If Pending Prices are lower than the previous month, then prices are likely to drop. Flat? Buyers and Sellers are still figuring things out.

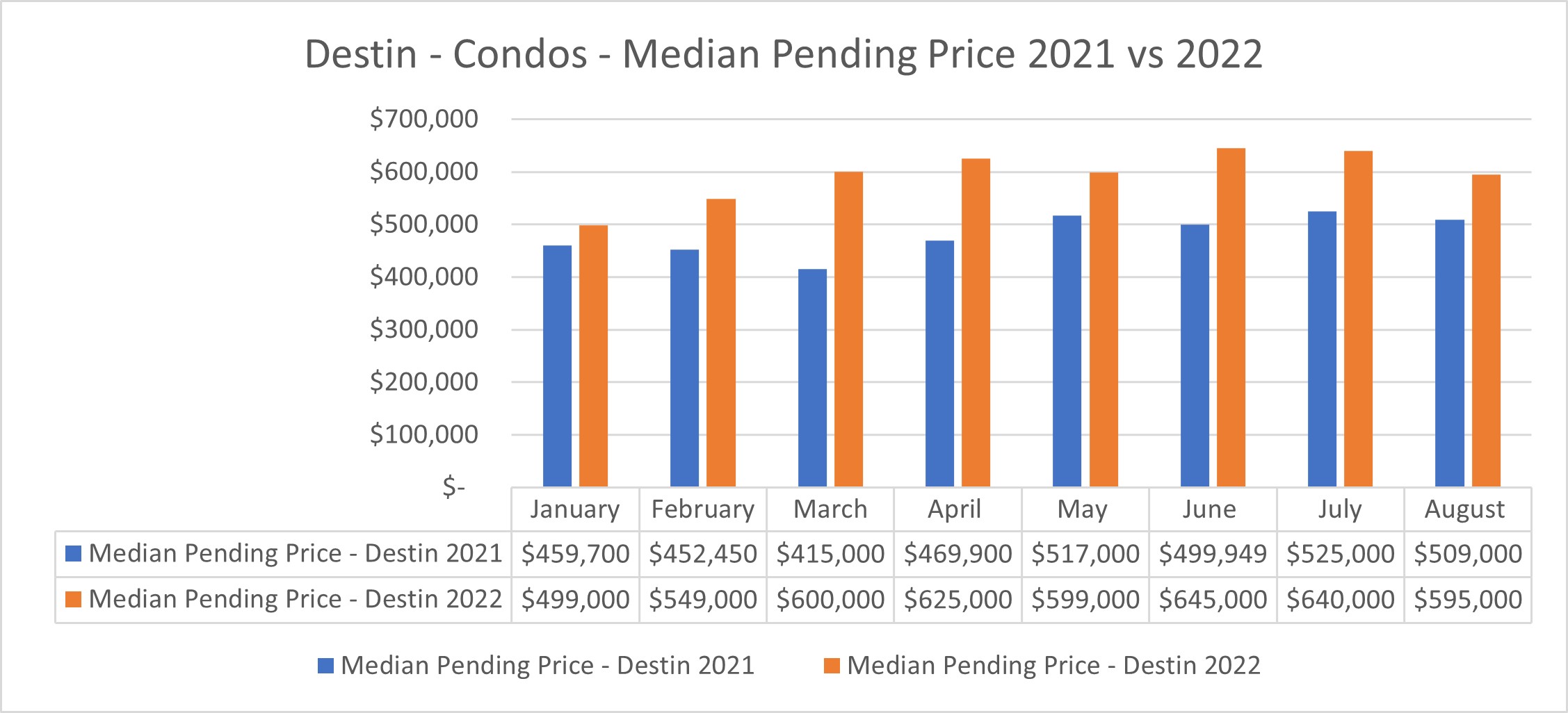

Destin Condos – Pending Price Trends: This is a big one for both buyers and sellers because it’s a good window into the future. Pending prices are up substantially year over year – no surprise there. As for the prices it looks like they have been within 7% from the highs to lows which is real money for sure but not a huge variance. We will watch to see if the lower prices of the August Pendings are the beginning of a trend or just another blip about to bounce back up.

Conclusion? Uncertainty is where the best deals can be made – for both buyer and sellers – so if you are thinking about buying or selling now would appear to be a good time to roll the dice.

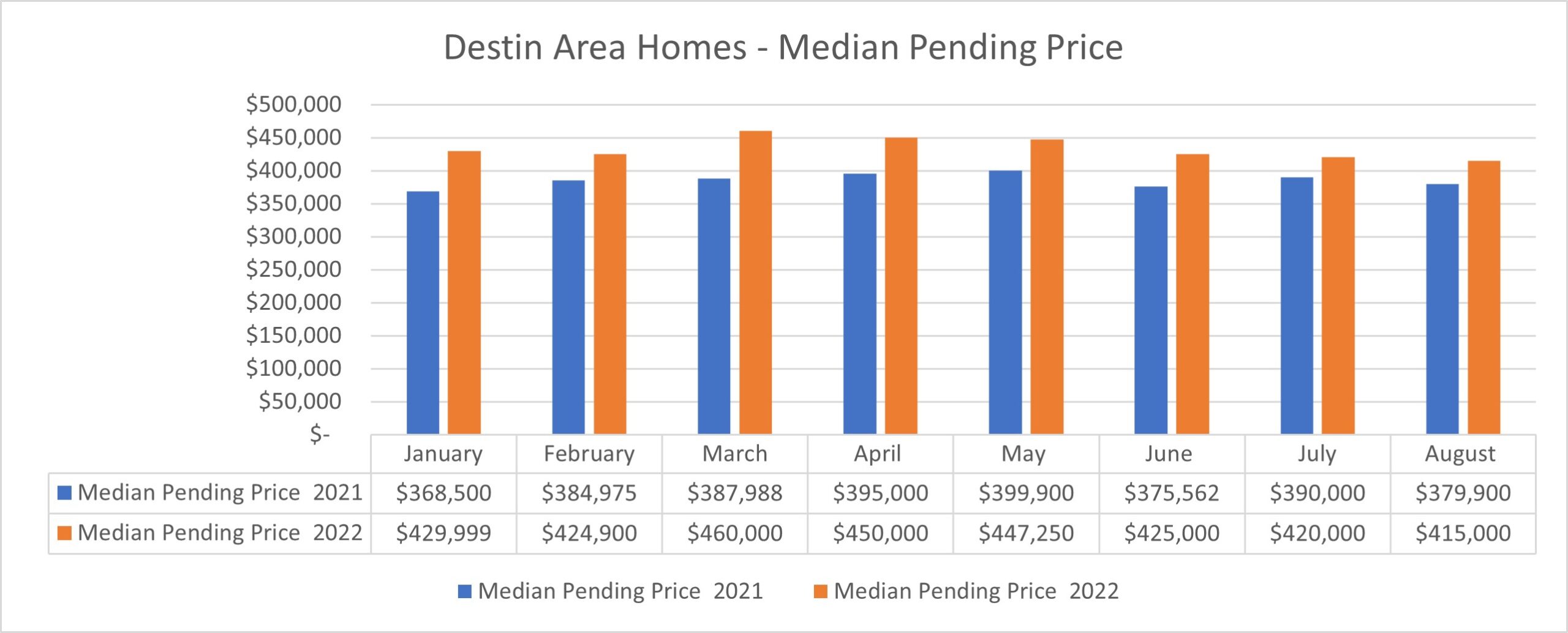

Destin Homes – Pending Sales Trends: Again, prices are higher this year than last year but, in both years, prices were pretty much flat throughout the year. There appears to be no drop off in prices which tells us that there are buyers out there that either need a home no matter what or believe that prices are going to be more in the future so they will pay today’s prices.

Conclusion? I do feel certain that prices will drop as much as some people are predicting.

Other Factors to Watch

Employment: Are people going to work or are they losing their jobs. Working people spend money on real estate and vacation rentals, unemployed people don’t. It’s as simple as that so keep an eye on employment.

Affordability: Can people afford to buy property or come to the beach on vacation? If they can’t or won’t then it will be very difficult to maintain the price points we’ve enjoyed for the past several years. With inflation the way it is and supply chain issues still a thing it’s going to be very interesting how they balance out against owner/sellers who aren’t feeling any strong pressure to lower prices… yet.

So, Where Are We?

By looking at these trends we can tell if people are confident in placing their hard earned and limited resources on properties here at the beach. Everything comes down to the confidence in the future – am I confident prices are going up or am I confident prices are going down? People, that’s what you need to watch and what you need to react to.

Right now, what we are facing is simple uncertainty, not a lack of confidence or an abundance of confidence. And until that uncertainty starts to lean one way or the other, we are going to remain in a spin mode going round and round rather than up or down. How long this will last is unknown, but you need to watch it very closely because when things move – they can move very quickly, and you don’t want to miss the boat on selling. Confidence is a fickle thing, and it could take a while for it to change and prices to change with it.

What Do You Do?

If you are an investor here at the beach and are considering selling – you need to be careful – there are very strong market forces at play right now. The market has been going up each year since 2009 which means most Realtors have never seen a declining market, and with hundreds of thousands of dollars – even millions of dollars – at risk… do you really want to trust your wealth to a Realtor that has never seen a market with eroding equity? Who you have as your Realtor… matters.

I was there in 2004, 05, and 06, when the market corrected, and prices were dropping by the day. We saw how buyers would walk away from earnest money deposits because they could buy a better property at an even lower price somewhere else. We successfully navigated those waters and were able to save or make our clients a ton of money.

Whether you are a buyer or a seller of a property here at the beach we, want you to max out your position based on your financial goals and the current market conditions. With this in mind and based on years of experience our advice breaks down as follows:

Short Term Owner (Five years or less): If you plan on owning your property for five years or less, we recommend that you list and sell it now. This allows you to lock in a really high sales price and mitigate all risk of price drops, tax code changes, and any other scenario that would have a negative impact on your profits. Remember, you can’t go broke taking profits.

Long Term Owner (Longer than five years): If you plan on owning the property longer that five years, we recommend that you simply sit back and enjoy the ride. This is because you have time to ride out the crazy ups and downs so they should not have much impact on you. We do suggest though that you look at your rental income and make sure you’re maxing that out. If you would like to get a FREE, No Obligation rental projection for your property we recommend you contact Beach Stays Vacations (beachstaysvacations.com)

Multiple Property Owner: If you own multiple properties, we suggest that you sell and take one or more off the table and protect the equity you’ve built up. Keep your best properties and consider adding new ones when prices drop.

Long Term Buyer (Going to own five years or longer): If you plan on buying a property that you will own for five years or longer, we recommend that you buy now… and hold it – longer the better. This will allow you to lock in a historically low interest rate and take advantage of high rental incomes. In addition, if you hold the property over time prices will go back up. If you do buy, we suggest that you max out your rental income.

If you would like to get a FREE, No Obligation rental projection for your property we recommend you contact Beach Stays Vacations (beachstaysvacations.com)

Short Term Buyer (Going to buy and flip): If you plan is to buy and flip the property, we simply say – be careful. Operating on a short time frame escalates the risk of missing the market – for sure, but we do have people who are doing this and making big money.

Bottom Line

We are wealth builders, so our goal (whether you are buying or selling) is to build or protect your wealth – based on your financial goals and the current market conditions. Call us today and lets talk about how you can max out your position as a buyer, a seller or as an owner to continue building your family’s wealth well into the future.

Committed to your success,

John Moran – CEO The Smart Beach Investor | Keller Williams Realty AT THE BEACH TEAM

Keller Williams Realty – For Your Place at the Beach